Shortage of cybersecurity talent

Security professionals are expensive and hard to retain

New compliance and regulation requirements

Undocumented processes in the event of an attack or breach

Security technology is expensive and hard to maintain

Technology alone can't deter motivated attackers

Lack of visibility across the enterprise

Difficulty managing multiple tools and investigating all alerts

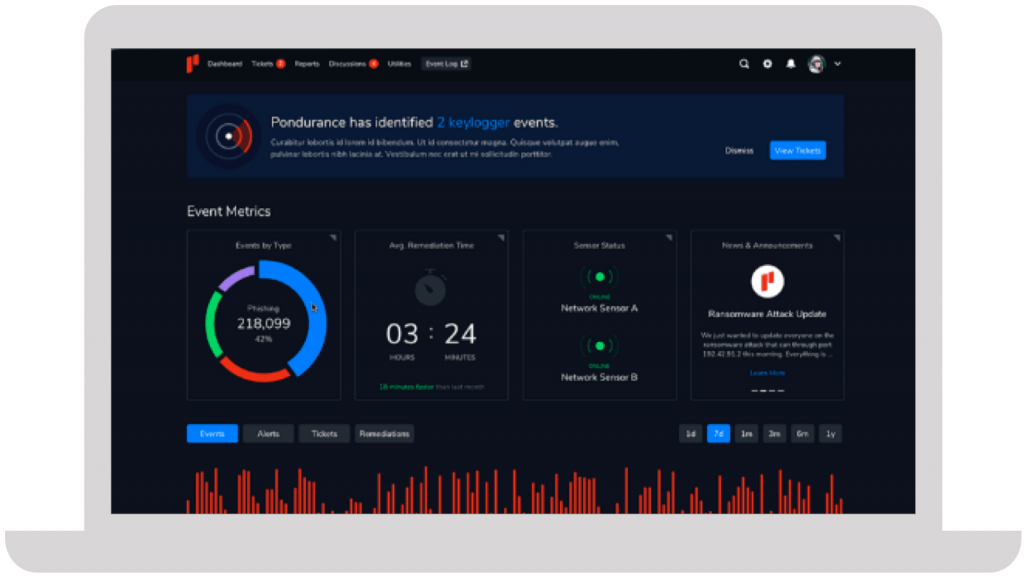

We take a personalized approach to developing your cybersecurity program. Instead of an all-or-nothing approach like other MDR providers, Pondurance lets you pay for what you need, without sacrificing the visibility and transparency you want.

The number of data breaches continues to escalate, putting small businesses on high alert. Nowadays, any information that a business finds valuable is monetizable and a potential target for attack. Learn more in our eBook.

Your company has its own unique set of cyber risks. Though you can’t control the evolving cyber landscape, you can control your cybersecurity strategy. But what’s the best strategic approach to cybersecurity today? Learn more in our eBook.

Join us on-demand to discuss components of MDR and how to choose the right provider for your organization.

They immediately proved their value and earned our trust due to their immense expertise and guidance throughout the entire process.

Steve Long, CEO @ Hancock Health

The financial services sector, serving as the backbone of the global economy, relies heavily on cybersecurity companies to safeguard its operations. In today’s digital landscape, where cyber risk and cyber threats loom large, top cybersecurity companies play a pivotal role in fortifying the security posture of financial institutions. These companies provide informed security solutions, assisting security teams in conducting risk assessments, managing cyber risk, and fortifying their defenses against potential threats, including data breaches and attacks on sensitive data and information systems.

Financial institutions, owing to the large flow of valuable data and significant sums of money transacted daily, are prime targets for cybercrime. Despite operating within stringent regulations, they often grapple with vulnerabilities stemming from complex legacy systems and evolving cyber threats. However, the industry is adapting by embracing comprehensive cybersecurity frameworks, proactive risk management strategies, and leveraging threat intelligence to stay ahead of cyber adversaries.

The transformative role of cybersecurity in fintech is particularly noteworthy, with service providers offering tailored solutions empowered by AI and machine learning. These solutions enable real-time threat intelligence and vulnerability management, enhancing the security posture of fintech companies against cyber threats.

Statistical data underscores the financial services sector’s vulnerability to cybercrime, emphasizing the importance of robust cybersecurity measures. Collaborating with cybersecurity partners like Pondurance, financial institutions bolster their cyber defenses, mitigate risks, and ensure the integrity of their operations. Together, they strive towards a safer financial world, resilient against cyber threats and potential impacts on the global economy.

Cyber threat assessments conducted by cybersecurity companies are instrumental in identifying potential threats and vulnerabilities within financial institutions’ networks and systems. By staying informed about emerging cyber threats and trends, security teams can proactively implement measures to mitigate risks and enhance their overall security posture. Additionally, ongoing monitoring and analysis of cybersecurity threats enable financial institutions to adapt their security strategies in response to evolving threats, ensuring they remain resilient in the face of cyber attacks.

Furthermore, cybersecurity companies offer specialized services such as penetration testing and incident response planning, which help financial institutions prepare for and respond effectively to cyber incidents. By simulating real-world cyber attacks and evaluating the effectiveness of their incident response procedures, financial institutions can better protect themselves against data breaches and other cybersecurity threats.

In conclusion, the collaboration between financial institutions and cybersecurity companies is essential for safeguarding the integrity of the global financial system. By investing in robust cybersecurity measures and partnering with trusted cybersecurity providers, financial institutions can mitigate cyber risks, protect sensitive data, and maintain the trust and confidence of their customers and stakeholders in an increasingly digital world.

In today’s digital age, characterized by relentless technological advancement, the financial sector faces an escalating battle against cyber threats. Cybersecurity breaches in the financial services industry, spanning banks, insurance companies, and investment firms, have sadly become commonplace, given the wealth of sensitive financial data they manage.

Given their status as prime targets for cybercriminals, financial institutions demand tailored cybersecurity solutions to address their unique needs. Pondurance and similar organizations play a crucial role in assessing these needs and implementing targeted measures to combat prevalent cyber threats effectively.

The reality of cyber risk in financial institutions cannot be overstated. These risks pose a significant challenge to existing cybersecurity measures, jeopardizing both financial performance and customer trust. Therefore, adopting a risk-based approach to cybersecurity is imperative to uphold financial integrity and maintain consumer confidence.

Recent high-profile cyber attacks on financial institutions, such as the 2014 breach at JPMorgan Chase, underscore the catastrophic consequences of cyber threats. Such incidents serve as stark reminders of the urgent need for robust cybersecurity measures.

Awareness of the imminent dangers posed by cyber threats is crucial, but action is paramount. Financial institutions, including banks, investment firms, and insurance companies, have recognized the imperative of cybersecurity. Faced with relentless waves of cybercrimes, they continually innovate their strategies to stay ahead of evolving threats.

In conclusion, addressing the evolving landscape of cybersecurity threats demands a dynamic, personalized, and outcome-driven approach. Financial institutions must enhance their cybersecurity capabilities, minimize cyber risk, and prioritize customer satisfaction and loyalty. These efforts are essential in achieving a secure and trustworthy financial sector, resilient against cyber threats.

Informed security teams within cybersecurity companies are vital in guiding financial institutions through cyber risk management challenges. Threat intelligence and cyber threat assessments provide valuable insights into potential threats, allowing proactive measures to be taken. Regular risk assessments help identify vulnerabilities in information systems, allowing for a comprehensive risk management strategy to be implemented. By fortifying their security posture and safeguarding sensitive data, financial institutions can mitigate the potential impacts of data breaches and emerging cybersecurity threats.

The necessity of cybersecurity in the banking sector cannot be overstated. Like singled out gazelles in a pack of zebras, banks have an unavoidable target on them making them primary victims of cyber breaches. Ponder upon the question – why are banks targeted for cyberattacks? Simple, they’re a powerhouse of abundance, brimming with valuable customer information and financial assets.

Contemporary society has seen some of the biggest cyber attacks on banks, causing havoc and sparking a sense of robust vigilance in the banking sector. But still, every now and then, we catch headlines reading, “cyber attack on banks today.” This chronicle repetition evinces the ever-evolving challenges faced in terms of cybersecurity in banking.

Looking at some examples of cyber attacks on banks, the audacious $81 million Bangladesh Bank heist of 2016 unravels the truly devastating potential consequences. Since then, cybersecurity threats in banking have considerably evolved, with the series of 2023 attacks marking some of the biggest cyber attacks on banks in history – a clear indicator of the escalating threat landscape.

Banks, large or small, grapple with daunting cyber-security challenges. For many small to medium-sized banks devoid of expansive in-house security operations, the threats seem insurmountable. However, such institutions have found solace in outsourced cybersecurity partners like Pondurance, that provide bespoke, risk-based cybersecurity strategies, multi-layered defenses, and 24/7 monitoring.

The importance of cybersecurity in banking is deeply rooted in its extensive potential to prevent financial disasters. Banks that adopt a holistic approach to cybersecurity, alleviating threats and instigating strong protective measures, experience immense returns on their investment – not just financially, but also in their reputation and trust from customers.

Nevertheless, cyber threats to banks are continuously changing, making the cyber landscape uncertain and challenging. However, as financial institutions leverage advanced cybersecurity measures and collaborate with specialized partners like Pondurance, they can combat cyber threats effectively, while ensuring a seamless, secure banking experience for their clientele.

Cyber risk management is at the forefront of every bank’s agenda, with proactive measures such as threat intelligence gathering and vulnerability assessments becoming standard practices. By staying ahead of potential threats and continuously enhancing their security posture, banks can mitigate the risks associated with cyber attacks and safeguard their customers’ sensitive financial information.

Furthermore, regulatory compliance plays a significant role in shaping banks’ cybersecurity strategies, with strict guidelines and requirements mandating robust security measures to protect against data breaches and cyber threats. By adhering to these regulations and implementing industry best practices, banks can demonstrate their commitment to cybersecurity and maintain the trust and confidence of their customers and stakeholders.

In conclusion, cybersecurity remains a top priority for banks worldwide, given the high stakes involved and the ever-evolving nature of cyber threats. By investing in advanced security technologies, partnering with trusted cybersecurity providers, and prioritizing proactive risk management, banks can effectively mitigate cyber risks and ensure the resilience of their operations in an increasingly digital world.